Contents

It warns that there could be a https://forex-trend.net/ reversal following a bearish trend. It’s important to remember that the inverted hammer candlestick shouldn’t be viewed in isolation – always confirm any possible signals with additional formations or technical indicators. Lastly, consult your trading plan before acting on the inverted hammer. The inverted hammer candlestick pattern is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signalling potential bullish reversal. Trading the inverted hammer candlestick pattern requires a trader to identify the pattern at the end of a downtrend and enter a long position.

- An inverted hammer candlestick is formed when bullish traders start to gain confidence.

- The small-size body of the candle constitutes the striking body, and the long-sized upper wick of the candle represents the handle – hence the name.

- The red line is the low, against which we place a stop-loss around pips beneath.

- Pick inverted hammers as part of a downward retrace in an existing up trend — page 361.

You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to Forex.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries. Here are the key takeaways you need to consider when using the inverted hammer candlestick pattern. The second trading technique to combine with the inverted hammer pattern is Fibonacci retracement levels. Below, we used the same chart from the first example but this time, with Fibonacci levels drawn from the lowest to the highest level. When you add the RSI indicator to your charting platforms, you’ll be looking for a crossover around the 30 level and at the same time, the inverted hammer candlestick appears.

You could do this by waiting a few periods to check that the upswing is underway, or by using technical indicators. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

The pattern is made up of a candle with a small lower body and a long upper wick which is at least two times as large as the short lower body. The body of the candle should be at the low end of the trading range and there should be little or no lower wick in the candle. Other indicators such as a trendline break or confirmation candle should be used to generate a potential buy signal.

While the https://en.forexbrokerslist.site/ is an important indicator, it cannot be used in isolation. You will have to support the indicator with other indicators to make an optimum trading decision. Pick inverted hammers as part of a downward retrace in an existing up trend — page 361. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is financial, investment, legal, tax or other advice and no reliance should be placed on it.

Experience our FOREX.com trading platform for 90 days, risk-free. I understand that residents of my country are not be eligible to apply for an account with this FOREX.com offering, but I would like to continue. Large volume on the session that the Inverted Hammer occurs increases the likelihood that a blowoff top has occurred. The fact that prices were able to increase significantly shows that there is buying pressure. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

Advantages of the Inverted Hammer Candlestick

Harness past market data to forecast price direction and anticipate market moves. Hammers occur on all time frames, including one-minute charts, daily charts, and weekly charts. 10 Best Bank for Savings Account in India 2023 – With Interest Rates Savings account is a type of financial instrument offered by several banks. Harmonic patterns are one of the most efficient and effective trading patterns. What is Buy the Dip Strategy in Trading – Working and Example ‘Buy the dip’ is one of the most common phrases in the stock market.

It is an important pattern widely used during the technical analysis of stocks and charts. If you place trades or invest in the stock market, you must understand the inverted hammer candlestick pattern. An Inverted Hammer is a candlestick pattern typically seen at the bottom of a downtrend. It is a bullish reversal pattern, signaling that there is potential for the price to begin moving upwards. The Inverted Hammer occurs when there is pressure from buyers to push the asset’s price up.

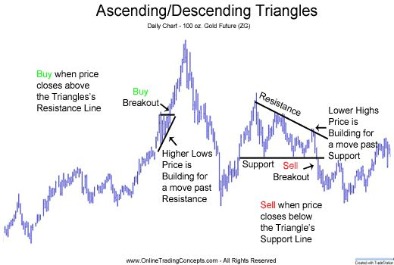

In essence, the shooting star and inverted hammer candlestick patterns look the same and share the same characteristics. However, the main difference between the two patterns is the market condition on the trading charts on which they appear. The chart above of the S&P Mid-Cap 400 ETF illustrates a bottom reversal off of an inverted hammer candlestick pattern. The inverted hammer candlestick opens lower, but then bulls are immediately able to push prices higher. However, the bears completely reject the bullish gains and the price closes where it began for the day. It is important to note that even though the inverted hammer candlestick is on the chart, at this point the inverted hammer pattern is not complete.

Trading platforms

The footplate has also been made straight up and down instead of on an angle as per the feedback from customers on our 1.0 version. A morning star is similar to an inverted hammer but has a confirming candle. Inverted hammers within a third of the yearly low often act as continuations of the existing price trend — page 361. If you want a few bones from my Encyclopedia of candlestick charts book, here are three to chew on.

An inverted hammer shows a trend reversal, but you must look for other indicators like a double bottom or a V-bottom to reach a conclusion. The inverted hammer appears whenever there is a downtrend and shows the possibility of a higher price movement. The candlestick’s small body indicates that the stock price has fallen, and the stock sellers have lost some market control.

The inverted hammer is a two line candle, the first one is tall and black followed by a short candle line of any color. The inverted hammer is supposed to act as a bullish reversal and that makes sense from the picture. However, for an upward breakout to occur , price has to close above the top of the candle pattern, and that is more rare than a downward breakout. Thus, this candle acts as a bearish continuation because price frequently continues lower.

However, as there’s a high risk of entering a position at the end of a trend, it is also important to confirm the pattern with other technical indicators. How to trade the hammer candlestick pattern As stated earlier, a hammer is a bullish reversal pattern. It occurs at the end of a downtrend when the bears start losing their dominance. In the chart below, we see a GBP/USD daily chart where the price action moves lower up to the point where it prints a fresh short term low.

How to Identify the Inverted Hammer Candlestick Pattern?

Secondly, use other tools such as the Relative Strength Index and Fibonacci levels to confirm the price reversal. Finally, use the low of the inverted hammer candle as a stop loss level. An Inverted Hammer candlestick pattern is typically found at the bottom of a down-trending market. With a long upper shadow, it may be a warning of a potential change in price.

It is exactly the hhttps://topforexnews.org/h close that signals that the bulls have just assumed control over the price action, as they defeated the bears in an important fight near the session lows. A doji is a trading session where a security’s open and close prices are virtually equal. If you have an open short position that’s profiting from a downtrend and you spot a hammer, it might be time to exit before an upward move eats into your profits. When the low and the open are the same, a bullish, green Inverted Hammer candlestick is formed and it is considered a stronger bullish sign than when the low and close are the same . The Inverted Hammer formation is created when the open, low, and close are roughly the same price. Also, there is a long upper shadow which should be at least twice the length of the real body.

What happens during the next candlestick after the Inverted Hammer pattern is what gives traders an idea as to whether or not the price will push higher. Although in isolation, the Shooting Star formation looks exactly like the Inverted Hammer, their placement in time is quite different. The main difference between the two patterns is that the Shooting Star occurs at the top of an uptrend and the Inverted Hammer occurs at the bottom of a downtrend . It is important to note that the Inverted pattern is a warning of potential price change, not a signal, by itself, to buy. What happens on the next day after the Inverted Hammer pattern is what gives traders an idea as to whether or not prices will go higher or lower. As mentioned, the inverted hammer has a very clear shape and it is fairly easy to identify this pattern on all currency pairs and in any time frame.

Confirmation occurs if the candle following the hammer closes above the closing price of the hammer. Candlestick traders will typically look to enter long positions or exit short positions during or after the confirmation candle. For those taking new long positions, a stop loss can be placed below the low of the hammer’s shadow. While the inverted hammer candlestick is one of the most talked about candlestick patterns, others are equally significant too. An inverted hammer is a candlestick pattern that looks exactly like a hammer, except it is upside down. Despite being inverted, it’s still a bullish reversal pattern – indicating the end of a downtrend and the beginning of a possible new bull move.

The Inverted Hammer And Its Powerful Reversal Signal

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite.

How Do You Trade on an Inverted Hammer Candlestick?

The body should be located at the lower end of the trading range. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.

The inverted hammer pattern indicates that the traders might buy the stock at a lower price. Post such purchases, the buyers in the market ensure that the stock price goes up, creating an inverted hammer candlestick. To trade when you see the inverted hammer candlestick pattern, start by looking for other signals that confirm the possible reversal. If you believe that it will occur, you can trade via CFDs or spread bets.

The overall performance rank is 6 out of 103 candle types, where 1 is the best performing. The pattern does best in a bear market after an upward breakout, ranking 9th for performance. A FOREX.com demo comes with £10,000 virtual funds and access to our full range of markets.Open your demo account here. A City Index demo comes with £10,000 virtual funds and access to our full range of markets. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

.jpeg)