Contents

If you’re thinking about entering into forex trading in 2022, this is the best time to invest. Perhaps the closest one will come to challenging the dominance of some of these legacy global payment systems is through central bank digital currencies, said Navin Surya, chairman emeritus of Payment Council Of India. Both the retail and wholesale versions of CBDCs, if introduced widely, will make transaction and settlement easier and faster. “It might be better to take that route rather than build a legacy institution to beat another legacy institution.” John has completed two amazing trading courses, the first is “Trading Triggers – The Secrets to Profitable Trading” and a four hour special FOREX trading course available for purchase on our website and his latest DVD course.

Fexgrid’s mission is to become one of the leading companies known primarily for robotic trading and to build a community around the same concept. The customer-centric approach of the team makes them extremely focused on providing their services with utmost transparency. “The software is prepped in-house and uses artificial intelligence to analyse market trends and to make instant trade decisions,” says Mr. Thajudheen, Managing Director of Fexgrid. Fexgrid is a group of young fintech enthusiasts providing advanced technology solutions in the world of forex trading.

Windsor Books

It took us a few months to find a suitable answer but it worked finally, and I i could save thousands of Dollars compared to other code writers. We are a young venture with major focus in designing and coding Automated Trading Systems on forex, stocks, futures, commodities, options, binary options. The Uttarakhand government has moved swiftly to revoke the recent ban announced by Uttarakhand Ayurveda and Unani Licensing Authority on… With the introduction of CBDCs, the dependency can be reduced over a period of time, provided there is focus and coordination, said Surya.

- Combined – This trading system is characterized by the use of tools from other types.

- Every FX company needs a digital trading business management system, which is referred to as a CRM.

- This is a manual procedure that can take up to two days at times because of verification procedures and bureaucratic issues.

- Mr Damir is clearly not a native English speaker, but I’ve had no problem reading any of his books, or indeed understanding anything he has written.

After an optimization period, a trader can be satisfied with his algorithm and test it using a demo account. Our company profile is listed among top 2 rank on Interactive Brokers marketplace for consultancy on automated trading systems and algorithmic trading software. In other words, this program opens and closes trading positions in accordance with the advisor’s settings, that is, it works according to a specific algorithm. The programmer who created the advisor puts into its work a certain trading strategy, the use of certain indicators, taking into account certain conditions, factors and market trends, on the basis of which deals are opened. Almost all online trading brokers on the Internet have this feature enabled on their platforms. The trader only needs to set up and optimize the EA correctly.

Forex Conquered: High Probability Systems and Strategies for Active Traders (Wiley Trading) Hardcover – 17 April 2007

My trading style is more to that of a price action swing trader. I have learned over the years to have patience and wait for the best trading opportunities the market provides. If you intend on successfully trading in today’s foreign exchange market, you need to be familiar with the strategies and systems that can help you capture consistent profits and effectively manage risk. A forex trading robot is a slang term for algorithmic trading that uses a collection of forex market signals to determine whether to buy or sell a currency pair at any time. These systems are frequently fully automated and linked to online forex brokers or exchange platforms. Arjun Abraham Zacharia, Founder of trade facilitation platform EximPe, says MSMEs that undertake cross-border trade run their businesses in a manual, on-the-phone, paper-heavy and in-branch manner.

The share of the U.S. currency has fallen from over 70% in the late 90s. India uses a mix of dollars, euro, pound sterling, Japanese yen, among other, but does not disclose the precise share. The reserves held in dollars are mostly in the form of U.S. treasuries or cash holdings within the U.S. either with large banks or regional federal reserve banks like the Federal Reserve Bank of New York. This gives the U.S. powers to freeze those asset or prevent their liquidation. Again, the risk of such actions were part of the deliberations at the Reserve Bank when the local Rupay network was first proposed when YV Reddy was governor, said Padmanabhan.

It has led to a constant change in dynamics inside the forex trading arena, resulting in changes in demographics as well as how people trade. Here, too, the risks of holding a large part of a nation’s reserves in one currency haven’t traderoom escaped notice. While central banks, including the RBI, have diversified reserves over the years, there is a limit to this strategy. In the short term, there will be implications on global inflation, investment and trade.

Person has appeared regularly on CNBC and is widely quoted by Reuters and MarketWatch from Dow Jones. He has also written many articles for major investment magazines, and is the author of A Complete Guide to Technical Trading Tactics and Candlestick and Pivot Point Trading Triggers . To resolve documentation issues in cross-border trade, his firm has come up with a blockchain platform for secure and speedy transfer of ownership of bills of lading in real time. Following the principles of universal automation of life, trading advisors appeared on Forex – nothing more than automatic trading systems. Behind each of them is a simple algorithm for opening and closing a deal, as well as its support under certain conditions. New traders can start with a demo account in order to test the different strategies available.

What is Forex Trading System

In the medium term, there will be implications for geopolitics and strategic alliances, Prasad wrote. The most significant advantage is that it may assist you to improve your income. A CRM can help you operate more efficiently by automating your processes and managing customer Software Engineer Vs Programmer data. This also means you have more time to focus on activities that will help you increase your income, such as developing new strategies or marketing your company. Every FX company needs a digital trading business management system, which is referred to as a CRM.

This is a useful way to see if automated trading suits them. And one of the most popular automated and manual trading platforms is MetaTrader. So you can download MetaTrader and explore all its features for trading multiple asset classes. This is a marked difference from those who believe that their manual trading rules will work in an automated trading system.

In addition, a CRM can help you strengthen relationships with your existing clients. By keeping track of their contact information and purchase history, you can provide them better service and build a stronger foundation for future transactions. CCIL also acts as a trade repository for OTC interest rate and forex derivative tradeallcrypto (xcritical) transactions. In order to sustain growing foreign exchange trading volumes the client needed to replace its existing FLEX product processor that was unable to scale up to volumes. The existing system lacked the ability to differentiate between deals that required automation and those that required manual processing.

When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures.

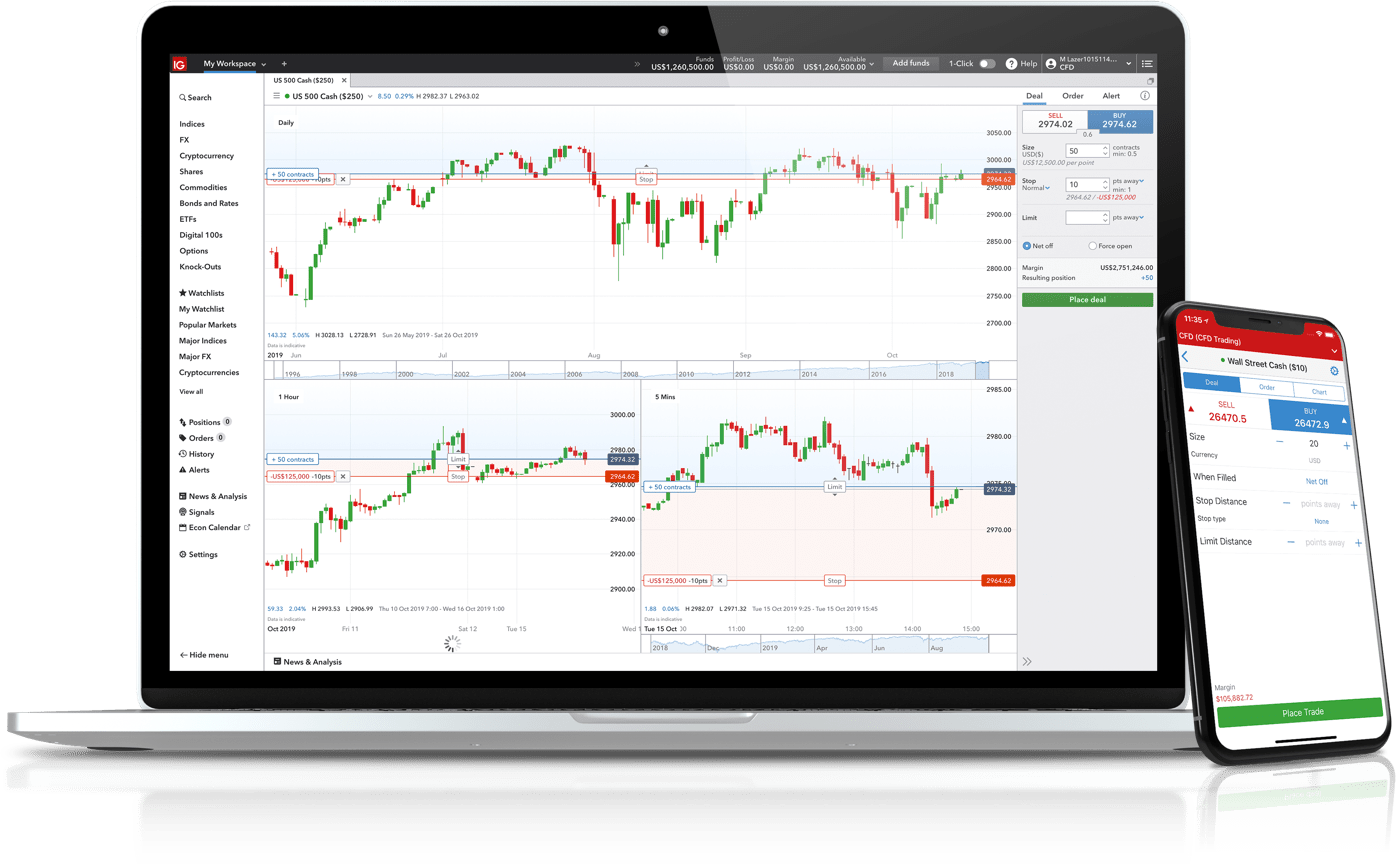

What is The Best Forex Trading Platform?

Forex advisors are indispensable assistants to a trader in the international currency market – trading robots or just bots. No truly successful Forex trader can do without trading robots these days. Expert Advisors trade around the clock, knowing neither tired nor emotions. According to statistics, 88% of successful traders are trading robots. Algorithmic Trading Systems execute trader’s orders into market via trading platforms with discipline approach, zero manual intervention, no emotional decisions, and with strong & low risk management.

You need to carefully study its work, thoroughly understand its settings, and also find out what algorithm this particular advisor uses. It is best to do this on a demo account, and then think about transferring it to a real account or not. Any even the best trading system, embodied in a profitable Expert Advisor today, may lose its relevance tomorrow, which is why trading robots tend to “become outdated” and require constant monitoring and periodic optimization. Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. While better exposure management remains key in tackling forex fluctuations, adoption of technology can make a big difference too, claim industry observers. Auto TraderCompletely removes emotion from trading decisions. This website is using a security service to protect itself from online attacks.

SWIFT’s current governance structure is such that each nation’s usage of messaging services determines its shareholding and number of directors on the board. This gives a wide set of nations representation but the developed economies, by virtue of larger usage, still have control. Some safeguards, however, were put in place such as asking SWIFT to set up a separate local network and data storage for operations in India, said G Padmanabhan, former executive director of the RBI. That dominance has now been weaponised to impose sanctions on Russia, which invaded Ukraine last week. If you are a Forex broker looking for an edge in customer service, then you need to invest in a Forex CRM system. Not all CRMs are created equal, so it’s essential to do your research and find one that fits your specific needs.